Empower Financial Services Teams Across Every Function

CloudTalk helps financial services teams handle critical client calls with speed, accuracy, and compliance. Whether you’re closing a deal, resolving a dispute, or following up on applications, you’ll get the calling tools you need to succeed.

-

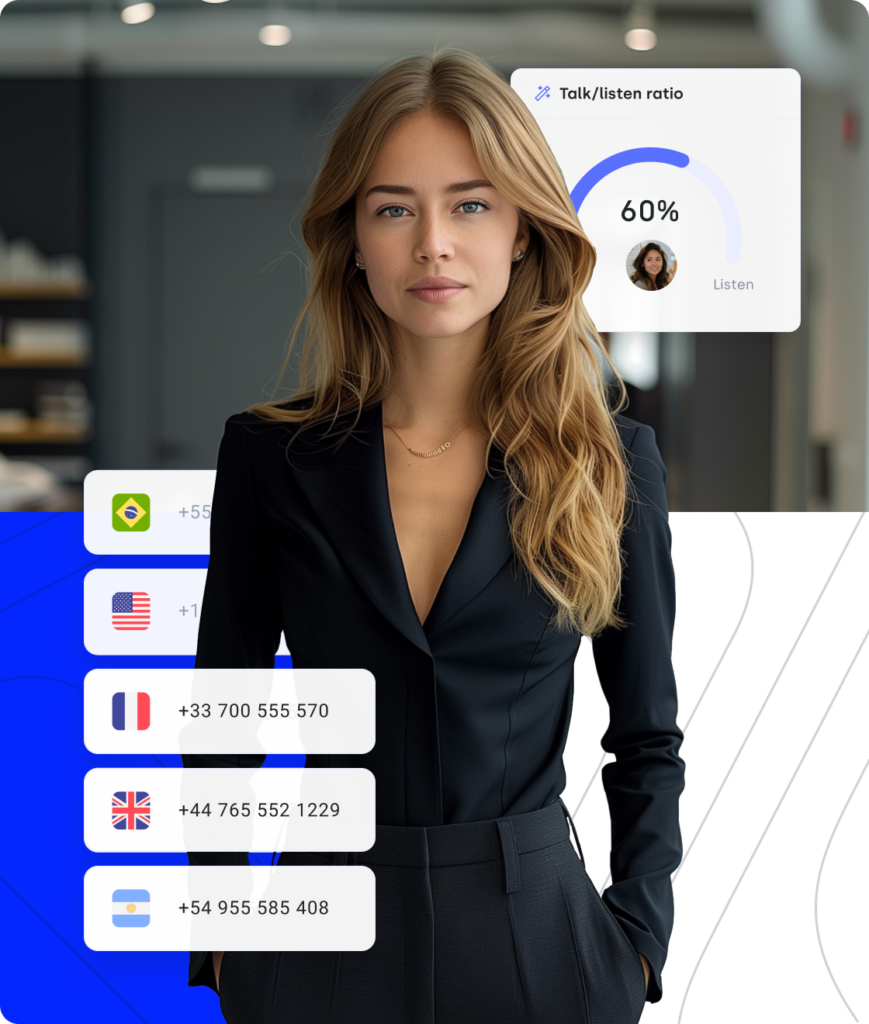

Numbers in 160+ countries to help you connect with clients

-

Call recording and detailed logs to ensure compliance

-

Smart routing and workflows to direct clients to the right team

Hello! Fill out the form; it only takes a minute.

81.7%

Increase of call volume

Call volume got 81.7%↑, missed calls got 23.7%↓.

2.5X

Outbound success rate

Doubled their outbound success & halved lost deals.

80%

Decrease in wait time

Wait times cut by 80% and call handling time by 25%.

Just a Few Examples

of How We Help

Insurance: Close More Policies, Faster

Simplify client communication for renewals and new policies with smart call flows and tracking, keeping agents focused on sales and leads.

Investment Firms: Build Stronger Relationships

Track and log every call for easy follow-ups. AI summaries, smart notes, CRM integration, and VIP queues ensure your team delivers personalized service to top clients.

Real Estate Financing: Drive Loan Conversions

Ensure efficient borrower communication by logging every call, routing inquiries to the right officer, and scheduling callbacks to keep the loan process on track.

HOW WE HELP

Must-Have Features

Financial Services Rely On

Signature Capability

Put Humans to the Test. See if 24/7 AI Voice Agents Will Outperform.

CeTe is an AI that talks like a human: no breaks, no training, no time off. It makes and answers calls, updates CRMs, books meetings, and loops in a human only when needed.

Press play to hear it. Want a wow moment? Get a free test call and try it live.

AI Voice Agents

Sales Reminder

Agent

Client

Sales / Marketing

Course Inquiry

Agent

Client

Education / EdTech

Payment Reminder

Agent

Client

Financial Services

Healthcare Intake

Agent

Client

Healthcare

Insurance Intake

Agent

Client

Insurance

T&C Acceptance

Agent

Client

Legal Services

Legal Intake

Agent

Client

Legal Services

Candidate Feedback

Agent

Client

Recruitment / HR

Applicant Pre-screen

Agent

Client

Recruitment / HR

Action Reminder

Agent

Client

SaaS / Software & Apps

Subscription Renewal

Agent

Client

SaaS / Software & Apps

CX Feedback

Agent

Client

SaaS / Software & Apps

Post-Sales Feedback

Agent

Client

SaaS / Software & Apps

Trial Signup

Qualifier

Client

SaaS / Software & Apps

Why CloudTalk?

With so many choices, why is CloudTalk the go-to for financial services companies?

SUPERIOR CALL QUALITY

Make Every Client Call Sound Like You’re in the Same Room, Not Miles Apart

Forget dropped connections or garbled conversations during crucial discussions. When you’re handling sensitive financial matters, every word needs to be crystal clear.

With CloudTalk, your team can focus on explaining complex financial products and building trust, not asking clients to repeat themselves.

160+ LOCAL NUMBERS

Do Your International Clients Trust Unknown Numbers? Neither Would You.

Want to build credibility in global financial markets? Easy.CloudTalk gives your agents local numbers in over 160+ countries, so every call feels like it’s coming from a trusted local institution, not an overseas center.

CloudTalk is easy to set up and use. Very intuitive interface, easy to keep track of the call history for everyone using it. It’s also very easy to see which agents are offline and online and the integration option makes it easy to use in combination with other CRM platforms.

Compliant and Easy To Manage

Compliance Made Simple for Growing Financial Teams

For companies in financial services, managing sensitive client data shouldn’t be complicated or time-consuming.

CloudTalk gives your team the tools to stay compliant and efficient, with features like the ability to pause or stop recordings during sensitive discussions, and recording deletion options to meet data retention policies.

Easily onboard new advisors, adjust call flows to fit your operations, and stay aligned with regulations like STIR/SHAKEN—without adding unnecessary IT complexity.

KEEP EVERYTHING UNDER THE SAME ROOF

Integrations That Keep Your Client Data In Perfect Sync

Keep your agents focused on clients, not copying data between systems. CloudTalk connects seamlessly with Salesforce, HubSpot, Zoho and other systems to maintain a complete record of every client interaction.

Whether you’re tracking loan applications or investment consultations, automated call logging ensures every conversation is properly documented for compliance and follow-up. No more missing call records or manual CRM updates between client meetings.

Ready to Get Started?

Start Making Calls in 4 Simple Steps:

01

Book a quick demo

02

Get your numbers

03

Integrate your tools

04

Watch your teams succeed

FAQs

What Is a Financial Services Call Center?

A financial services call center is a secure communication hub that handles client interactions across banking, insurance, and investment services. It combines security with automation to manage high-volume financial transactions while maintaining regulatory compliance.

What are The Benefits of Call Center Software for Financial Services?

Modern call center software cuts operational costs by 40% through AI automation and smart routing. It ensures regulatory compliance, enables secure global operations, and provides detailed analytics for performance optimization. Teams can handle more calls while maintaining service quality and security standards.

What are the use cases for financial service call center software?

Banking teams use it for secure transaction processing and account services. Insurance providers handle claims and policy inquiries. Investment advisors manage client consultations.

How Does a Financial Services Call Center Improve the Customer Experience?

Smart routing connects clients to the right advisor instantly. AI-powered analytics help teams understand customer needs and optimize service delivery. Integration with CRM systems ensures consistent, personalized service across all channels while maintaining security protocols.

Why is call center software for financial services important?

Call center software is essential for financial services, enabling teams to drive sales, nurture client relationships, and streamline support while ensuring top-tier security and compliance. Sales teams use it to acquire clients and boost revenue, relationship teams enhance retention and lifetime value, and support teams resolve issues efficiently. From insurance and investment firms to fintech and real estate financing, it empowers every team to scale operations, protect sensitive data, and meet regulatory standards seamlessly.

What are the Best Practices for Training Agents at Financial Services Call Centers?

Successful training combines compliance knowledge with communication skills. Teams use call recordings for coaching, automated quality checks for consistency, and real-time analytics for performance improvement. Regular security awareness training ensures data protection.

CloudTalk is built to simplify calling operations with reliable AI business calling

Schedule a demo today to see how CloudTalk can support your teams.