How to Increase Customer Lifetime Value: 7 Expert Tips for 2025

Customer lifetime value (CLV) is one of the most important revenue metrics and can serve as the biggest driver of growth. Unfortunately, companies often underestimate it in leu of lead generation and new business. In this article, we hope to change your mind.

Prepare to learn about the importance of CLV in business growth, all the ways customers can cost and make you money, and the 7 secret strategies experts use to maximize their customers’ lifetime value.

Key takeaways:

- CLV expresses a customer’s total purchases across the entire time spent with your company. It can be historical, predictive, or comparative.

- By monitoring CLV, businesses can save money, prevent customer attrition, and build a bigger pool of top-spending customers through targeted marketing.

- To understand how profitable your business is, you need to be able to calculate and compare customer acquisition costs and customer lifetime value.

Why Is CLV Important for Business Growth?

Whether you’ve been tracking your customers’ lifetime value for years or are just now beginning to come around to the idea of starting, there are a number of benefits that should motivate you to make the most of this metric. These include:

#1 CLV Saves You Money

As anyone who’s ever worked in sales will tell you, finding and converting leads into customers is no simple task. It takes time, effort, and money. A lot of money! Data shows that closing a new deal is 5x more expensive than upselling.

So, although new business is vital, it shouldn’t be your only revenue driver. Sales processes targeting existing customers have an average success rate of 60% – 70%, whereas new customers are only around 5% – 20%.

By focusing your efforts on customer retention and maximizing customer lifetime value, you can easily create profit while saving money on the tasks required to convert a lead.

#2 CLV Helps Spot & Stop Attrition

One important question to ask yourself when examining customer lifetime value is not only “how much?” but also “why?” Customer behavior can help identify predictors of profitability and churn.

So, if you notice a high CLV customer decreasing their engagement with your brand across all touchpoints in a way that’s out of the usual, it’s a good sign they may be at risk of leaving. Churn costs US companies $136,8 billion annually.

However, that’s an opportunity in disguise. When you notice a customer beginning to disengage, that’s your time to hit them with a re-engagement campaign, whether it be an email, call, or ad, and retain your profits.

#3 CLV Helps Cultivate a Better Overall Customer Base

However, understanding customer behavior is a good way of preventing churn and increasing your pool of high-CLV customers. Assumedly, most of your top spenders have several attributes that tie them together.

By identifying these characteristics and predictors for interested parties, you can customize your lead-gen efforts to focus on this particular type of customer. Appealing to these personas can boost your bottom line for years to come.

Unlock Your New Power!

How Much Are Your Customers Costing You?

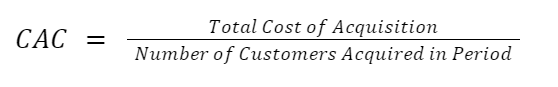

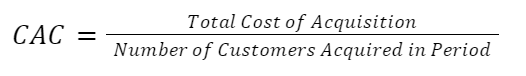

Those familiar with CLV should also have an intimate understanding of customer acquisition cost (CAC). As the name suggests, this metric describes how much it costs your business to acquire a new customer.

It’s impossible to properly nail down an average CAC because it differs so much across industries and business types. However, data suggests that it can be estimated at $702 for SaaS, $536 for B2B, and $70 for eCommerce.

You can calculate your own customer acquisition cost by choosing a specific time period based on your sales cycle – month, quarter, or year – and using the following formula:

For example, if you paid $10,000 for 100 customers in the first quarter of this year, your CAC would be $100. In other words, that’s how much customers are costing you. But don’t put away your calculators just yet because there’s more to this.

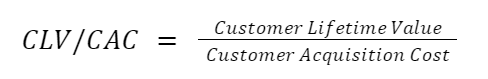

To maintain profitability, your CLV must be higher than your CAC. The ideal ratio between the two metrics is usually around 3:1 CLV/CAC, as anything below that means you’re losing customers too fast, and above means you’re not growing fast enough.

How to Measure CLV?

You may have noticed that despite incorporating customer lifetime value into the previous calculation, we’ve not yet discussed how to enumerate it. But before we can do so, we need to choose the approach best suited for your specific use case.

Top-Line Approach

The Top-Line approach to CLV focuses on revenue generated by a customer without deducting any costs. This method is simpler and provides a quick estimation of the total revenue a customer is expected to bring over their lifetime.

Calculating CLV with the Top-Line Approach

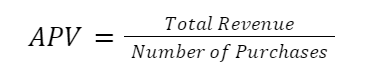

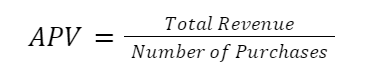

- Calculate Average Purchase Value (APV):

We start the process by calculating the average amount spent by a customer in each transaction. The formula for this is:

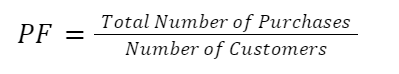

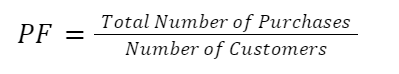

- Calculate Purchase Frequency (PF):

Next, you’ll want to determine the average number of purchases made by a customer in a specific period of time. The formula for this is:

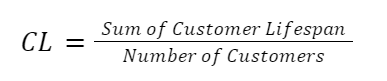

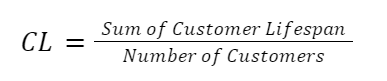

- Calculate Customer Lifespan (CL):

Estimate the average duration (usually in years) that a customer continues to make purchases from the business. The formula for this is:

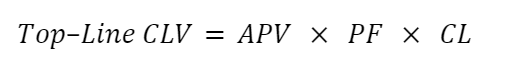

- Calculate Top-Line CLV:

Finally, you’re ready to calculate your top-line customer lifetime value. For this, you’ll need to multiply the previous three values. In other words:

So, for example, if your average purchase value is $100, the purchase frequency is 5x per year, and the customer lifespan is 3 years, your Top-Line CLV is $1,500.

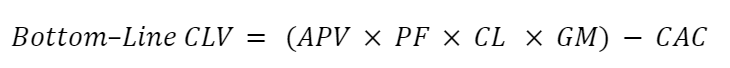

Bottom-Line Approach

The Bottom-Line approach, also known as the profit-based approach, considers both the revenue and the costs associated with serving a customer. This method provides a more accurate and comprehensive measure of a customer’s profitability over their lifetime.

Calculating CLV with the Bottom-Line Approach

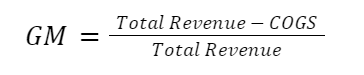

- Calculate the Gross Margin (GM):

We start the process by calculating the gross margin, which represents profit, after deducting the Cost of Goods Sold (COGS) from revenue and interpreting the final number as a percentage. The formula for this is:

- Calculate Average Purchase Value (APV):

Continue by calculating the APV as you would for the Top-Line Approach.

- Calculate Purchase Frequency (PF):

Continue by calculating the PF as you would for the Top-Line Approach.

- Calculate Customer Lifespan (CL):

Continue by calculating the PF as you would for the Top-Line Approach.

- Calculate Customer Acquisition Cost (CAC):

Continue by calculating the CAC. In other words:

- Calculate Bottom-Line CLV:

Finally, we can fill in the numbers from the previous calculations to get an accurate idea of your customer’s lifetime value.

So, for example, if we assume the same values for APV, PF, and CL as we did for Top-Line CLV, with a gross margin of 50% and CAC of $300, then:

- Revenue = 100 x 35 = $1500

- Gross Profit = 1500 x 0.5 = $750

- Bottom–Line CLV = 750-300 = $450

Types of Customer Lifetime Value Data

Customer Lifetime Value can be calculated and analyzed using different types of customer lifetime data, each with its own approach and application. Below, we’ll discuss the three most important types: historical, predictive, and comparative.

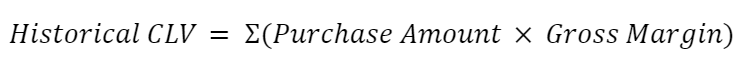

Historical Model

Historical CLV calculates a customer’s value based on their past interactions and transactions with the business. This model looks at the actual revenue generated from a customer up to the present moment.

Key Characteristics:

- Retrospective: Focuses only on past interactions and transactions.

- Simple: Easier to calculate, as it doesn’t forecast future behavior.

- Accurate: Highly accurate for past behavior, but not future.

Use Cases:

- Evaluating Performance: Assesses the actual revenue contribution of existing customers.

- Retention Efforts: Identifies high-value customers based on past transactions to target retention activities.

How to Calculate:

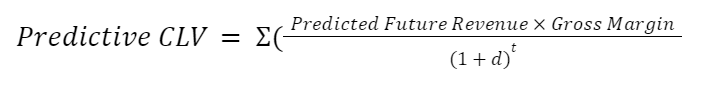

Predictive Model

Predictive CLV uses statistical models and algorithms to forecast the future value a customer will bring to the business over their entire lifetime. This approach combines historical data with predictive analytics.

Key Characteristics:

- Predictive: Estimates future purchasing behavior and value.

- Complex: Uses machine learning, regression analysis, and other techniques.

- Dynamic: Can be updated regularly with new data to improve accuracy.

Use Cases:

- Marketing Strategies: Helps in designing personalized marketing campaigns based on predicted customer value.

- Resource Allocation: Guides investments in customer acquisition and retention by identifying high-value prospects.

- Product Development: Informs product and service enhancements to meet the needs of high-value customers.

How to Calculate:

For the following, assume that “d” is the discount rate to account for the time value of money and “t” is the period of time in the future.

Comparative Model

Comparative CLV involves comparing the CLV of different customer segments or groups. This approach helps businesses understand the relative value of different customer cohorts.

Key Characteristics:

- Segment-Based: Focuses on comparing segments rather than individual customers.

- Benchmarking: Provides benchmarks to assess the performance of various customer groups.

- Strategic Insights: Offers insights into which segments are most valuable and where to focus efforts.

Use Cases:

- Targeted Marketing: Helps identify and target the most profitable customer segments.

- Customer Prioritization: Guides customer service and support prioritization based on segment value.

- Performance Metrics: Provides a metric for evaluating the effectiveness of marketing and sales strategies across different segments.

How to Calculate:

Maximize Your Revenue!

7 Expert Strategies to Improve CLV

#1 Kickresume

Thought leader: Peter Duris, CEO at Kickresume

What Is It?

Kickresume is a resume and cover letter builder designed to help job seekers create professional and visually appealing application documents. With a wide range of templates and customization options, it enhances candidates’ chances of landing their dream jobs.

How does the company enhance CLV?

Use of advanced data analytics to create personalized interactions with users.

“By understanding their journey and needs, the company offers tailored recommendations and proactive support akin to having a personal career coach. This approach boosts customer satisfaction, increases CLV, and reduces CAC.

Additionally, happy customers naturally refer new users, and retention strategies enhance acquisition efforts, creating a cohesive and effective customer management strategy.”

What is the main challenge impacting the company’s CLV?

High churn rates.

“Users often cancel their subscriptions after completing their resumes. To address this, our team analyzed the customer journey and identified additional needs, such as career development tools and networking opportunities.

By introducing these services, the company increased customer engagement and retention. The key takeaway is to look beyond a product’s immediate use case to discover additional needs and add value, thereby keeping customers longer.”

What tools does the company use to better forecast analytics?

“We use advanced analytics platforms like Mixpanel to integrate data across our touchpoints to effectively view each customer’s journey. This allows us to forecast future behavior and potential lifetime value, helping identify at-risk customer segments for intervention.”

#2 Convertcart

Thought leader: Harsh Vardhan, CRO expert

What Is It?

Convertcart is a comprehensive conversion rate optimization platform that empowers e-commerce businesses to boost their online sales by optimizing their websites, improving user experiences, and leveraging advanced analytics and insights for increased conversion rates.

How does the company enhance CLV?

Personalized email marketing campaigns.

“We tailor emails to customers’ interests and purchase history to increase engagement and repeat purchases, enhancing CLV in the process. Personalization also carries the knock-on effect of improving CSAT and loyalty, while reducing customer churn.

This approach helps us create a cycle where personalization drives higher CLV, improves retention, optimizes resource allocation for customer acquisition, and results in mutual benefits for all stakeholders.”

What is the main challenge impacting the company’s CLV?

Data fragmentation

“To address the issue of data fragmentation, we integrated our systems, allowing for a comprehensive view of each customer. By unifying data on browsing behavior, purchase history, and email interactions, we can tailor campaigns specifically for increasing CLV.

In our view, breaking down data silos is essential for achieving a holistic customer view. Furthermore, focusing on customer journeys in their entirety rather than isolated transactions effectively enhances the customer experience.”

What tools does the company use to better forecast analytics?

“The RFM (Recency, Frequency, Monetary) model is an innovative measure of CLV. It assesses customers based on their recent purchases, purchase frequency, and total spending to segment them effectively.

This segmentation aids in predicting future customer value. In addition to calculating CLV, RFM offers valuable insights such as:

- Identification of high-value customers: Pinpoint customers with frequent purchases and high monetary value, enabling targeted nurturing campaigns.

- Prediction of customer churn: Customers showing low recency scores may indicate potential churn, prompting targeted retention strategies.

- Targeted product recommendations: Utilize RFM segments to suggest products tailored to customers’ purchase histories.

This data-driven approach transcends a simplistic CLV calculation by revealing customer behavior patterns. It empowers businesses to make strategic decisions that enhance retention efforts effectively.”

#3 Mailtrap

Thought leader: Veljko Ristić, Marketing Manager

What Is It?

Mailtrap is an Email Delivery Platform to test, send, and control email infrastructure, all in one place! It’s suitable for both dev and marketing teams.

How does the company enhance CLV?

Service expansion

“After substantial market analysis and client feedback, we transitioned from an email testing solution to a comprehensive email delivery platform. This has allowed us to address diverse infrastructure needs and offer a broader range of services.

The long-term benefits are significant despite the increased CAC associated with these initiatives, including investment in development and scaling support operations. These efforts have proven effective in enhancing customer retention and substantially increasing CLV”

What is the main challenge impacting the company’s CLV?

Coordination of service development efforts across multiple teams

“New services had to seamlessly integrate into existing systems and perform flawlessly in production. Additionally, our marketing team had to revamp their communication strategy for the product offering.

Fortunately, established product inception and management protocols minimized bottlenecks. A critical aspect in our field was implementing a robust pipeline to deter spammers, which now features cutting-edge security systems, machine learning models, and professionals.”

Key takeaways for other businesses include:

- Implement clear protocols for operational procedures.

- Define team accountabilities clearly and enforce adherence.

- Prioritize building a Minimum Viable Product (MVP) that is reliable and scalable.

- Base decisions strictly on data rather than intuition or preferences.

What tools does the company use to better forecast analytics?

“Our strategy uses diverse tools and techniques for predictive analysis and segmentation, such as Google Analytics and HubSpot. Our analytics team has also developed custom machine learning models to improve data accuracy and identify potential challenges or focus areas.

Success with these methods hinges on industry, niche, company size, and overall business model. It’s advisable to start with mainstream tools like Google Analytics, SalesForce, or HubSpot and then transition to more tailored solutions as your business grows.

For more advanced capabilities, consider using Keras or TensorFlow to build custom predictive CLV models based on historical data. Additionally, RFM analysis can segment customers into value tiers, optimizing marketing efforts and resource allocation.”

#4 Barn2

Thought leader: Katie Keith, CEO at Barn2

What Is It?

Barn2 develops WordPress plugins that enhance website functionality and user experience. Their high-quality, easy-to-use plugins cater to various needs, from improving e-commerce operations to creating dynamic content displays helping businesses optimize their WP sites.

How does the company enhance CLV?

Introducing a ‘Tier 3’ support engineer role

“This has enhanced CLV by bridging development and support teams. Our engineers pinpoint the exact causes of bugs, speeding up resolutions and freeing lead developers to focus on innovation, resulting in quicker solutions, higher CSAT, and improved conversion rates.

Investing in this role has also reduced customer acquisition costs by increasing retention and spreading acquisition costs over a longer period, ensuring a better ROI. This commitment to customer satisfaction strengthens loyalty and enhances lifetime value.”

What is the main challenge impacting the company’s CLV?

Managing a surge in support tickets following the launch of new complex solutions

“This strain on resources hindered our team’s ability to provide timely, high-quality support crucial for customer satisfaction and loyalty. In response, we scaled up our support team by 65%, including hiring additional ‘Tier 3’ support engineers.

This decisive move effectively managed the influx of queries and maintained support quality, significantly improving CSAT and retention.

The key takeaway for other businesses is the importance of swift action and investment in support infrastructure to sustain customer trust and loyalty during unforeseen challenges.”

What tools does the company use to better forecast analytics?

“At Barn2, we use advanced analytics platforms to enable precise CLV measurement and forecasting by integrating data across customer touchpoints, including Google Analytics and specialized CRM software.

This approach tracks purchase histories and captures interactions with support services, providing deep insights into customer behaviors and evolving needs. It also allows us to analyze CLV factors to help with strategic resource allocation to boost our key metrics.

For instance, faster support responses have been linked to higher renewal rates, underscoring the importance of investing in support capabilities. Such informed decision-making effectively supports Barn2’s long-term business objectives.”

#5 Internxt

Thought leader: Mia Naumoska, CMO

What Is It?

Internxt offers decentralized cloud storage solutions with a focus on privacy, security, and user control, utilizing blockchain technology to ensure end-to-end encryption and data redundancy. Their services promote eco-friendly and secure data storage alternatives.

How does the company enhance CLV?

Offering free tools and flexible subscriptions to tailor the user experience to individual needs

“This personalization underscores our commitment to user privacy. It addresses customer concerns and prioritizes data protection by recommending relevant security features based on individual needs.

This approach builds trust and provides peace of mind, encouraging users to rely on the company for their most sensitive data, especially amid data breaches and leaks.”

What is the main challenge impacting the company’s CLV?

Balancing the complexity of advanced features with highlighting their general benefits.

“Features like end-to-end encryption, zero-knowledge privacy, and open-source software benefits may need clarification for those new to online privacy. To address this, resources have been created to help users understand these benefits and values.

A dedicated help center provides explanations, walkthroughs, and answers to common questions, while a live customer support team offers additional assistance if needed. By anticipating problems and providing solutions, we were able to holistically boost CX.”

Innovative Technique to Better Forecast CLV:

“Customer Cohort Analysis is a technique for measuring and forecasting CLV. By analyzing purchase behavior and churn rates within cohorts, businesses can identify high-value customer segments and target them with specific marketing campaigns or loyalty programs.

It can also measure marketing campaign effectiveness by comparing the behavior of cohorts across different channels. These insights reveal which customer segments engage most with specific products or services, helping asses product-market fit and guide future development.

Customer Cohort Analysis offers valuable insights into customer behavior, enabling businesses to optimize marketing strategies, improve product offerings, and maximize customer lifetime value.”

#6 ScreenPal

Thought leader: Ben Wellington, Director of Customer Success and Support

What Is It?

ScreenPal, formerly Screencast-O-Matic, is a user-friendly screen recording and video editing tool. It enables users to capture, edit, and share high-quality videos effortlessly, making it ideal for creating tutorials, demos, and engaging visual content for various purposes.

How does the company enhance CLV?

Targeted automation strategies focused on customer value

“Prioritizing first response times has been a key initiative driven by the understanding that meeting service level agreements (SLAs) significantly influence customer satisfaction and retention.

Automation tailored to account value has notably reduced first response times across all agents. Moreover, implementing a comprehensive library containing video, visual, and text templates for FAQs has streamlined agent responses, enhancing efficiency while delivering detailed solutions.

These improvements in response times and overall customer satisfaction directly contribute to higher retention rates. The company has observed that enhanced satisfaction levels also lead to increased referrals, thus indirectly lowering customer acquisition costs.”

What is the main challenge impacting the company’s CLV?

Mapping out customer journey segments and pinpointing initial value moments

“We created a cross-function team dedicated to this very endeavor. Subsequently, we reviewed onboarding messaging and automation to facilitate prompt customer action and early value recognition, as we recognized this as key for boosting retention and CLV from day one.”

Innovative Technique to Better Forecast CLV:

“We focus on transparency and cross-functional alignment above all. We hold weekly meetings focused on our core metrics, which help us ensure continuous data review, impact tracking of initiatives, and prioritization of new tasks.

This keeps us focused on projects that deliver maximum value both to our customers and business.”

#7 Outgrow

Thought leader: Sr. Marketing Analyst

What Is It?

Outgrow is an interactive content creation platform that allows businesses to build calculators, quizzes, and assessments to engage their audience. By offering personalized experiences and actionable insights, Outgrow helps companies generate leads, engagement, and conversions.

How does the company enhance CLV?

Regular contact and feedback from customers

“This has shown clients how customer input is valued and implemented. Additionally, we meet with customers regularly to truly understand their products and identify areas where we can help them improve.”

What is the main challenge impacting the company’s CLV?

Overcoming complexity to prioritize usability and essential product functionalities

“Engaging in collaborative solution development was pivotal; we delivered prototypes and conducted rigorous user testing to validate the benefits of our simplified design.

From this experience, the key lesson is clear: understanding fundamental user needs and fostering collaborative development processes can surpass expectations in enhancing user satisfaction.

This approach underscores the importance of businesses prioritizing user-centric design and iterative testing to achieve optimal outcomes in product development.”

What tools does the company use to better forecast analytics?

Customer Journey Mapping enhances touchpoints and optimizes CLV. Predictive analytics tools, including machine learning algorithms, analyze historical data to accurately forecast future customer behavior.

These insights inform strategic decisions such as personalized marketing campaigns, targeted customer retention strategies, and optimized resource allocation. This approach aims to boost customer satisfaction and long-term profitability.

Conclusion

As this article shows, customer lifetime value is a crucial revenue metric that businesses often underestimate. Crucially, however, the tides seem to be changing. Seven market-leading companies have already chosen to pursue CLV as a key revenue driver, and they’re not alone.

Strategies like personalized interactions, targeted email campaigns, service expansion, support innovations, and others allow companies to save money, prevent customer attrition, and cultivate a larger base of high-spending customers.

And now that you know how to calculate, evaluate, and optimize your CLV, you can do the same.

FAQs

What does customer lifetime value (CLV) mean?

Customer Lifetime Value (CLV) is a metric that estimates the total revenue a business can expect from a single customer account throughout the entire business relationship.

It considers the customer’s revenue contributions over time, factoring in purchase frequency, average order value, and the duration of the customer relationship.

CLV helps businesses understand the long-term value of their customer base, enabling better strategic decisions in marketing, sales, and customer service.

How do you calculate a customer’s lifetime value?

Calculating a customer’s lifetime value typically involves the following steps:

1. Determine Average Purchase Value: Calculate the average amount a customer spends per purchase. Use: Average Purchase Value = Total Revenue/Number of Purchases

2. Calculate Purchase Frequency Rate: Find out how often a customer makes a purchase over a specific period. Use: Purchase Frequency Rate = Number of Purchases/Number of Unique Customers

3. Compute Customer Value: Multiply the average purchase value by the purchase frequency rate to get a customer’s value over the specified period. Use: Customer Value = Average Purchase Value x Purchase Frequency Rate

4. Estimate Customer Lifespan: Determine the average length of time a customer continues to buy from the business.

5. Calculate CLV: Finally, multiply the customer value by the customer lifespan to estimate the customer lifetime value. Use: Customer Lifetime Value = Customer Value x Customer Lifespan

Example:

If the average purchase value is $50, the purchase frequency rate is 4 times per year, and the average customer lifespan is 5 years, the CLV would be: CLV = 50 x 4 x 5 = $1,000

Is customer lifetime value the same as NPV?

No, Customer Lifetime Value (CLV) and Net Present Value (NPV) are not the same, though they are related concepts:

1. Customer Lifetime Value (CLV): As described, CLV estimates the total revenue a business can expect from a customer over the entire duration of their relationship with the business. It focuses on revenue generation from a customer over time.

2. Net Present Value (NPV): NPV is a financial metric used to evaluate the profitability of an investment or project. It calculates the present value of all expected future cash flows (both inflows and outflows) discounted back to their value today. NPV accounts for the time value of money, considering that money today is worth more than the same amount in the future due to its potential earning capacity.

While CLV can be enhanced by using NPV to discount future cash flows and provide a more accurate estimate of the present value of future customer revenues, the two metrics serve different purposes.

CLV is primarily a marketing metric focused on customer profitability, whereas NPV is a broader financial metric used to assess the viability of investments.