Conversational AI in Banking: Key Applications and Benefits

According to a Markets and Markets report, the conversational AI market is projected to grow from USD 13.2 billion in 2024 to USD 49.9 billion by 2030.

In an era when customers expect faster service, banks must keep pace or risk falling behind. If you’re curious about conversational AI in banking, how it’s implemented, and its main benefits, read on.

Key Takeaways:

- Conversational AI in banking improves customer service with personalized, round-the-clock interactions, handling everything from basic inquiries to complex financial advice.

- Chatbots and virtual assistants guide transactions and account information, boosting accessibility and reducing wait times, among other use cases.

- Implementing conversational AI presents challenges such as integrating with legacy systems, ensuring robust data privacy and security measures, and maintaining highly accurate responses.

What Is Conversational AI in Banking?

Conversational AI in banking uses tools like chatbots and virtual assistants to let customers interact with banks 24/7 in a personalized and efficient manner, improving customer service. This technology allows simple inquiries, such as checking the account balance, to more complex ones, such as receiving financial advice on investment products.

Automate call insights for better coaching and happier clients.

7 Key Applications of Conversational AI in Banking

While AI doesn’t replace humans, it takes on much of the work. Let’s look at the most common uses of AI in banking.

#1 Customer Support

Chatbots and virtual assistants are available around the clock to help. This makes it easier for customers to get the assistance they need whenever they need it, without having to visit the bank, wait in line, stay on hold, or depend on customer service hours.

For example, imagine a customer wants to transfer money to a family member in another country but isn’t sure how to do it or what the costs are. Instead of waiting for the bank’s customer service hours, they can ask a virtual assistant available 24/7.

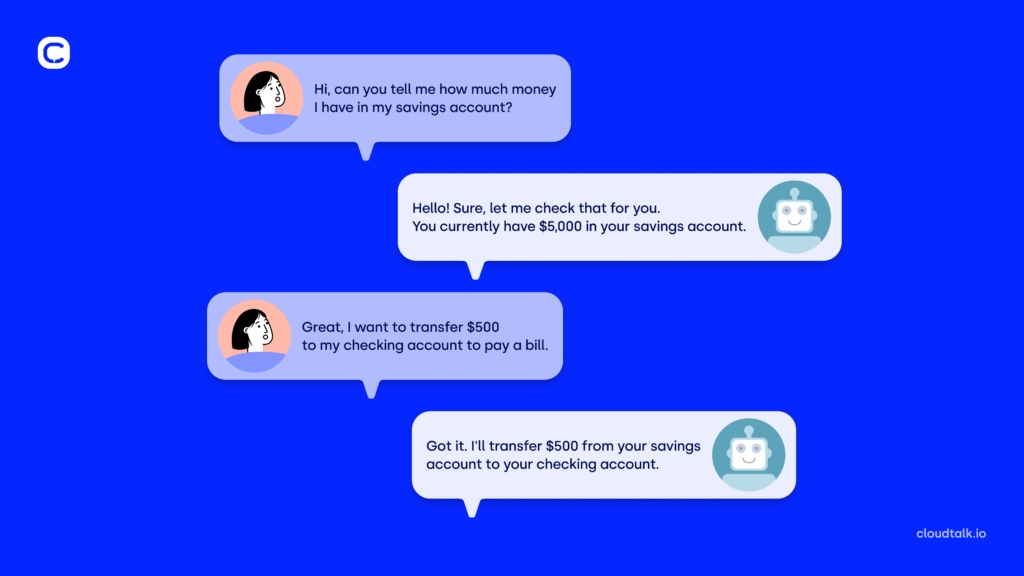

#2 Account Management

Conversational AI also makes it easier to manage your account with tasks like checking balances or transferring money just by typing or speaking to the chatbot.

#3 Personalized Financial Advice

Virtual assistants can offer personalized recommendations and financial insights based on the customer’s transaction history, spending habits, and preferences.

Banks can use this data to suggest smart investment products and retirement plans tailored to each user.

For example, the assistant might learn from the conversations with a customer that this person is saving for their children’s education and prefers low-risk investments. With this information, they can recommend a specific savings plan and safer investment funds.

#4 Fraud Detection and Prevention

Conversational AI systems monitor transactions in real time and promptly alert customers to suspicious activities so they can take immediate action.

But they don’t just react to potential threats; they predict them. They can analyze historical data to forecast potential fraud trends. This allows banks to implement preventive measures proactively.

For example, if the AI notices unusual spending patterns or transactions different from their typical behavior, it might predict a potential fraud attempt and notify the customers before any harm occurs.

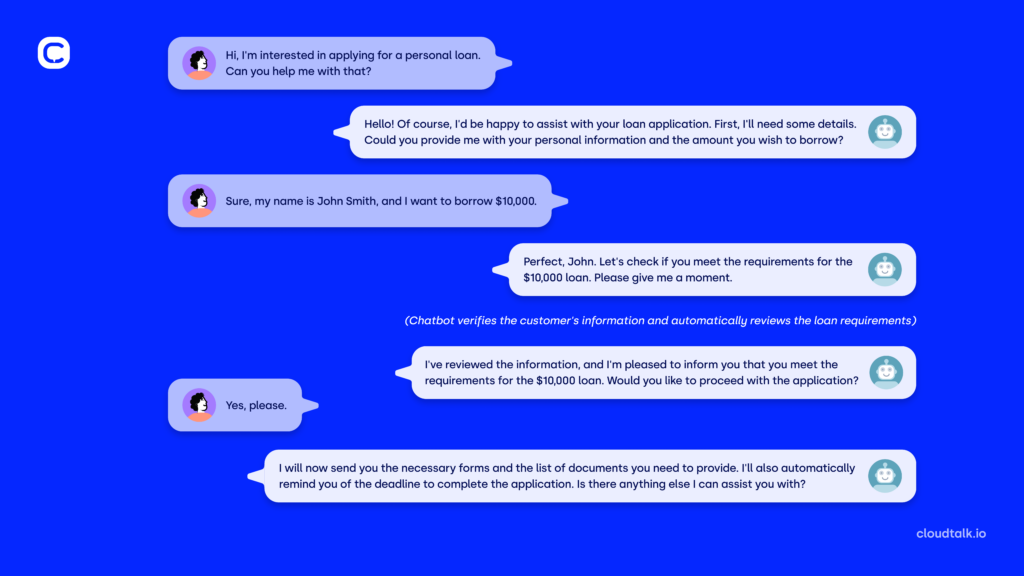

#5 Loan Applications and Processing

Conversational AI in banking helps customers apply for loans quickly by verifying if they meet the requirements and providing instant approval if they do. This simplifies the process of submitting documents, especially when applying for a first-time business loan and speeds up loan approval, reducing errors.

In addition, it also prevents issues like loan rejections due to missing documents and allows customers to manage everything from the comfort of their homes, saving time and hassle.

For example, imagine a customer who wants to apply for a personal loan. Here’s how a conversation with a chatbot might go:

#6 Customer Onboarding

Chatbots or conversational AI systems can interact with customers in a personalized manner from the first contact. They can answer specific questions about banking products and services, guide customers through registration forms, and provide real-time assistance.

For example, a chatbot might ask the customer about their primary goal (e.g., opening a checking account, savings account, or investing in funds).

Based on the customer’s responses, the chatbot requests necessary information such as full name, address, date of birth, and identification number.

#7 Payments and Transactions Reminders

Conversational AI chatbots and virtual assistants can also analyze your account information and send personalized reminders about upcoming bill payments, credit card due dates, and other transactions.

For instance, imagine you have a credit card and forget an important payment due before the 10th to avoid additional interest charges. An AI chatbot could analyze your spending history and remind you days before the payment is due.

Benefits of Conversational AI in Banking

77% of bankers believe AI will set winning banks apart. But what do you gain with conversational AI? Let’s look at the main benefits.

#1 Save Costs and Boost Efficiency

Conversational AI in financial services reduces costs by automating routine tasks and minimizing the need for additional staff during peak times. Consequently, banks can handle increased customer interactions without investing more in hiring.

#2 Improve Customer Service

AI-powered chatbots answer customer queries instantly and are available around the clock, avoiding delays and allowing customers to get help anytime. Moreover, AI analyzes customer data to tailor responses based on individual preferences and behaviors. As a consequence, customers get personalized information quickly, boosting their satisfaction.

#3 Make Data-Driven Decisions

AI analyzes data from customer conversations, providing insights into their behavior and preferences. For example, AI knows if some customers will close their accounts soon, so you can create targeted marketing strategies to prevent churn.

#4 Enhance Security

Conversational AI in banking ensures customer data is securely handled using encrypted channels and strict authentication processes. In addition, AI algorithms constantly learn and adjust to new threats, offering strong protection against changing cyber risks.

However, banks need to watch out for AI security risks, such as potential vulnerabilities in machine learning models or the risk of adversarial attacks. Banks must implement robust safeguards and regular security audits to mitigate these risks and maintain customer trust.

#5 Guarantee Compliance

If you work in a bank or financial institution, you know the strict regulations, including Anti-Money Laundering (AML) laws and data protection. Conversational AI in banking helps by verifying customer identities securely, monitoring for security threats during conversations, and automating tasks like regulatory reporting.

Challenges and Considerations

The benefits of implementing conversational AI in the finance industry are clear. However, like any new technology, it also presents challenges, such as:

- Integration with legacy banking systems: Banks often use outdated, locally installed core banking systems that must be integrated with modern AI technologies. To incorporate AI, they must develop APIs and switch to cloud-based solutions, requiring significant investment and ongoing management to keep data secure and reliable.

- Data privacy and security: AI accesses sensitive customer data, requiring strong security measures like encryption, access controls, and ongoing monitoring. Banks must handle large volumes of personal data responsibly, using data masking and tokenization methods to protect information and meet privacy regulations.

- Managing bias in AI systems: AI algorithms must make fair decisions, especially when recommending products tailored to individuals. Banks must regularly audit and adjust these algorithms to ensure they’re fair and transparent, reducing the chances of bias and upholding ethical standards.

- Achieving high accuracy: Ensuring AI consistently provides accurate information is crucial for customer trust and adoption. Banks make sure AI works well by training it with a lot of carefully selected data. Additionally, human oversight ensures that AI handles complex banking questions correctly. This ensures that AI is reliable and that customers are happy with the service.

Conversational AI Tools & Solutions for Banking

Although new AI tools in the banking world emerge daily, some of the most common AI solutions for banking include:

Chatbots

Chatbots are by far the most popular conversational AI tool for banking. They are accessible via banking apps, websites, messaging platforms, and voice assistants, providing customers with convenient and immediate assistance around the clock.

An example is Erica by Bank of America, which offers solutions like alerts, payment scheduling, balance checking, and a personal finance assistant.

Voice assistants

Sometimes, customers prefer not to type and communicate by voice. This is where voice assistants come into play.

These AI tools perform the same tasks as chatbots: checking account balances, transferring funds between accounts, paying bills, providing transaction history, and answering general inquiries about banking products and services.

For instance, voice assistants like Capital One’s Eno integrate with platforms like Amazon Alexa, allowing users to access chatbot functionalities via voice commands to perform tasks such as paying credit card bills.

FAQ bots

While both chatbots and FAQ bots use artificial intelligence to interact with users, chatbots are more versatile and interactive, handling diverse inquiries and tasks.

FAQ bots, on the other hand, are focused on quickly answering common questions with predetermined responses, often directing users to specific information sources.

Sentiment Analysis

Sentiment analysis refers to the use of natural language processing (NLP) to understand the feelings expressed in customer interactions, like messages or emails. These tools help banks understand customer emotions and feedback, but also improve product offerings based by analyzing customer sentiment trends.

Automate Insights, Amplify Customer Satisfaction

In conclusion, conversational AI in banking transforms customer experience through personalized, efficient, and secure interactions via AI-powered tools such as chatbots and virtual assistants.

In addition, it offers a game-changing opportunity to elevate customer interactions through data-driven insights.

Imagine transforming customer conversations with 100% automated call insights and saying goodbye to guesswork, boosting customer satisfaction. Learn more about the future of banking with Cloudtalk’s AI solutions.

See how you can automate call insights

FAQs

What type of AI is used in banking?

AI used in banking primarily involves machine learning algorithms that analyze vast amounts of data to detect fraud, personalize customer experiences, and automate processes like loan approvals and risk assessment. Natural language processing (NLP) helps with customer service through chatbots and sentiment analysis, enhancing overall efficiency and customer satisfaction.

What is an example of conversational AI?

An example of conversational AI is a virtual assistant like Amazon’s Alexa or Apple’s Siri. These systems use natural language processing (NLP) to understand and respond to spoken or typed queries from users, providing information, performing tasks, and controlling smart home devices based on voice commands. They continuously learn and improve their responses through machine learning algorithms.

How secure are Conversational AI interactions in the banking industry?

Conversational AI interactions in banking are generally secure because they use encryption to protect sensitive data and follow strict rules like GDPR and PCI-DSS. However, risks like phishing attacks and data breaches remain, which banks work hard to prevent by updating security measures regularly.

How quickly can banks implement Conversational AI solutions?

Banks can implement Conversational AI solutions relatively quickly, often within a few months to a year, depending on their existing infrastructure and the complexity of the AI system. The process involves planning, choosing a suitable AI platform or developing a custom solution, integrating it with existing systems, and testing for functionality and security. Rapid deployment is possible with the right resources and expertise, enabling banks to enhance customer service and operational efficiency promptly.